Dassault Systèmes Announces Third Quarter 2021 Results – Outlook for Realizing Manufacturing Transformation

On October 28, 2021, Dassault Systèmes announced its financial results for the third quarter 2021.

In this announcement, the company emphasizes year-over-year growth, but it should be noted that this is in comparison to last year, when the company’s performance was not so good due to the Covid-19.

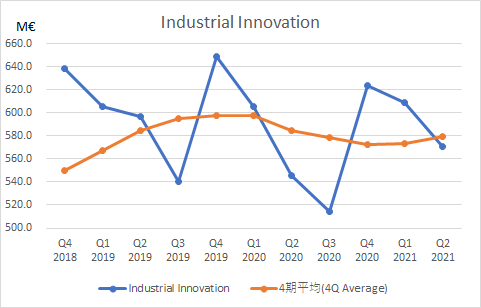

Industrial Innovation, which includes their mainstay products such as CATIA and ENOVIA, continued to recover on average over the past four quarters, but because of the significant decline in the previous year, the four-quarter average has barely returned to the level of two years ago. The situation is as follows. (See chart below)

Mainstream Innovation software, mainly SolidWorks, was up 13% from last year, and since it was up 9% a year ago, it can be said that this business is growing steadily.

Life Sciences software, which includes the MEDIDATA, acquired the year before last, and BIOVIA brand, was up 19% over last year.

The earnings forecast for the fourth quarter of this year has also been announced, and it is expected to be similar to the current situation, and the planned annual target is expected to be achieved.

Industrial Innovation Future Outlook

Now, how can we expect the company to perform in the medium to long term from next year?

I would like to take a look at our mainstay Industrial Innovation business.

At Capital Markets Day, held about a year ago on November 17, 2020, Dassault Systèmes stated that it expects software sales to grow at a CAGR of about 10% from 2020 to 2024.

In order to achieve this growth rate, industrial innovation will need to grow by about 8% per year. Since there was an exceptional situation with Covid-19 in 2020, it is unavoidable that this growth rate will not be achieved. Even so, can they achieve it after 2012?

The basic strategy of Dassault Systèmes is to realize virtual twins for all industries on the 3DEXPERIENCE platform to maximize the benefits for customers and society, while increasing its own sales and profits.

In terms of the automotive industry, which is Dassault Systèmes’ largest customer group, the case of Renault was mentioned in the earnings announcement, and it seems that this is exactly the kind of world Dassault Systèmes is aiming for. Specifically, we are looking at

- Greatly improve engineering efficiency by shortening development time, reducing the number of prototypes, and early coordination with suppliers

- The 3DEXPERIENCE platform in the cloud will enable a virtual twin that covers all areas of software development management, configuration management, compliance management, procurement management, etc., and will cover approximately 20,000 users.

There are no specific details about the specific application, schedule, or business size of Renault’s plan, but we hope that it will become clearer in the future.

If such examples can be replicated by automakers around the world, and even as well as in other industries, they will be able to achieve and even exceed their growth targets.

In addition, with the continued sales expansion of products such as DELMIA and SIMULIA, which are said to have performed well in this quater, and stable maintenance revenue including CATIA and ENOVIA, it is highly likely that the company can continue to grow to some extent.

On the other hand, there are some headwinds for Dassault Systèmes.

On September 27, 2021, PTC and the Volvo Group announced plans to further strengthen their cooperation on digital engineering in PLM system.

Volvo to integrate its CAD platform into PTC.

According to the article that broke the news, the decision will result in all of the company’s current CATIA installations being replaced by CREO.

The article also mentions the situation of global automakers, saying that CATIA users are not making much progress in migrating to the new version of 3DEXPERIENCE, which continues to make things difficult for Dassault Systèmes.

It seems that they may be lagging behind its competitors in the areas of IoT and MBD, which are key areas for these manufacturing companies in the future.

【Reference article】Gartner “Magic Quadrant for Industrial IoT Platforms”

[Reference article] Denso decides on Siemens as the foundation for model-based development?

As for Industrial Innovation, it will be interesting to see whether the company can return to its previous growth path even in the future, given that its sales had been gradually declining since 2019 before Covid-19.

The outlook for the company will become clearer in the next earnings announcement.

Trends in Business for the Manufacturing Industry

The digital transformation (DX) of manufacturing companies is expected to make significant progress in the future, and the business potential is expected to be large.

This year’s (2021) “Monozukuri White Paper” also states that it is important for manufacturers to appropriately utilize solutions for each business domain and promote data collaboration among them.

“In order for manufacturers to make efficient and strategic DX investments, it is important for them to accurately understand the roles they play in the value chain (sales, design and development, manufacturing, etc.) and to ensure that their IT solutions work together and that data is smoothly linked across business domains. It is important that the IT solutions work together to ensure smooth data integration between business domains.”

2021 Monozukuri White Paper

Japanese IT companies are also providing solutions to this market with the aim of achieving company-wide DX.

Hitachi is collaborating with PTC to promote collaboration between the engineering chain and the supply chain, and has acquired GlobalLogic with the aim of “connecting management and the field”.

[Reference Article] Hitachi Announces Alliance Program, Agrees to Cooperate with PTC to Link Engineering and Supply Chains

[Reference Article] Hitachi’s Acquisition of GlobalLogic: “Connecting Management and the Frontline in Real Time is a Major Force”

Panasonic acquires Blue Yonder to provide total supply chain solutions.

[Reference article] Panasonic’s Acquisition of Blue Yonder : What it really means.

Summary

Dassault Systèmes, as a 3DEXPERIENCE company, aims to further develop by realizing innovation in the manufacturing industry, but at present, there are many challenges to achieving this goal.

Medidata, which they acquired in 2019 at a huge cost, has the potential to expand its business, but we do not expect synergies with their current core industrial innovation business. In the fields of IoT and MBSE, which are closely related to their core business, they are already lagging behind the top runners, and it will be difficult for them to maintain their competitive edge as an integrated solution in these fields on their own.

As a result of expanding sales of each existing brand, it is expected that it will be possible to maintain sales for the time being and continue business expansion to some extent, but it is difficult to determine at this point whether it will be possible to obtain opportunities for significant growth in the medium to long term.

We need to continue to monitor how the digital transformation of the manufacturing industry, which is rapidly progressing around the world, will develop and which companies will take the lead as IT vendors.